w3techpanel.com insurance |

Insurance is a contract between an individual or entity (the insured) and a company (the insurer) whereby the insurer promises to compensate the insured for losses incurred in the event of a specific contingency or for a particular type of loss. The insured pays a premium to the insurer in exchange for this protection.

There are many different types of w3techpanel.com insurance, including:

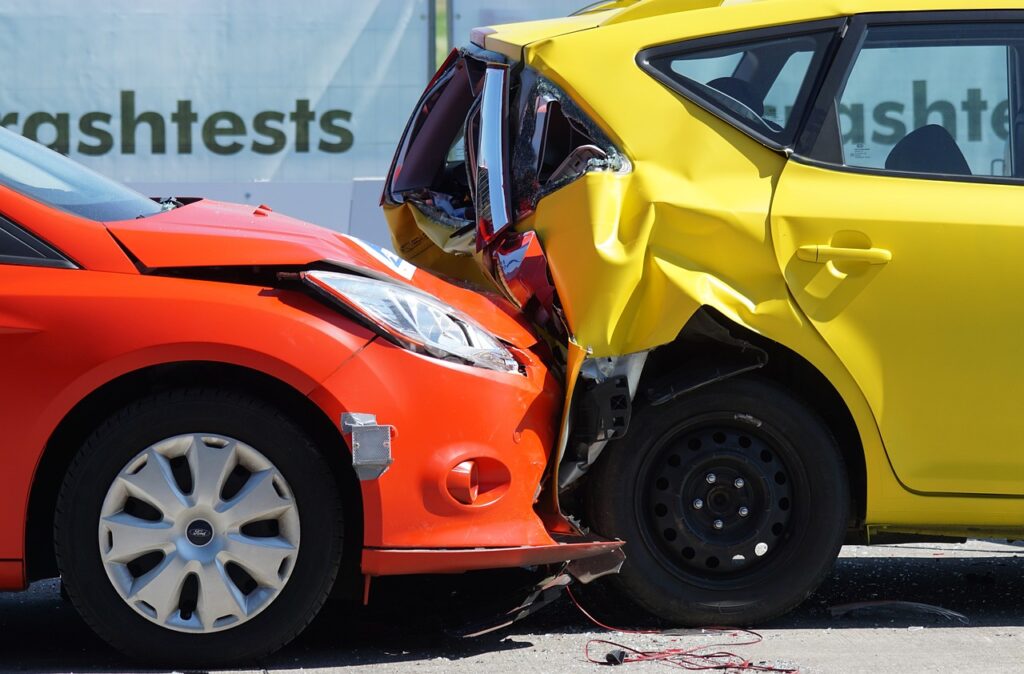

- Auto insurance protects you financially if you are involved in an accident.

- Homeowners insurance protects your home and belongings from damage caused by fire, theft, or other disasters.

- Life insurance provides financial support to your loved ones if you die.

- Health insurance covers your medical expenses, such as doctor’s visits, hospital stays, and prescription drugs.

- Disability insurance provides income if you are unable to work due to an illness or injury.

When choosing an insurance policy, it is important to compare quotes from different companies and to make sure that you understand the terms of the policy. You should also consider your individual needs and budget.

w3techpanel.com insurance

Here are some of the benefits of having w3techpanel.com insurance:

- Financial protection: Insurance can help you to protect your financial assets in the event of a loss. For example, if you have car insurance and you are involved in an accident, your insurance company will pay for the damage to your car up to the limits of your policy. This can save you a significant amount of money, especially if you have a newer car.

- Peace of mind: Knowing that you have insurance can give you peace of mind. You can rest assured that if something does happen, you will have financial assistance to help you get back on your feet.

- Compliance with the law: In some cases, insurance is required by law. For example, most states require drivers to have car insurance. If you are caught driving without insurance, you could face fines or even jail time.

| Type of Insurance | Purpose | Example | Image |

|---|---|---|---|

| Auto insurance | Protects you financially if you are involved in an accident. | Covers damage to your car, medical expenses if you are injured, and liability if you injure someone else. |

|

| Homeowners insurance | Protects your home and belongings from damage caused by fire, theft, or other disasters. | Covers the cost to repair or replace your home and belongings, as well as liability if someone is injured on your property. |

|

| Life insurance | Provides financial support to your loved ones if you die. | There are many different types of life insurance policies, so you can choose one that fits your needs and budget. Some policies pay out a lump sum upon your death, while others provide income to your loved ones for a set period of time. |

|

| Health insurance | Covers your medical expenses, such as doctor’s visits, hospital stays, and prescription drugs. | There are many different types of health insurance plans available, so you can choose one that fits your needs and budget. Some plans are employer-sponsored, while others are purchased individually. |

|

| Disability insurance | Provides income if you are unable to work due to an illness or injury. | This can be a lifesaver if you have a job that pays well and you cannot work for an extended period of time. Some disability insurance policies pay out a percentage of your salary, while others pay a lump sum. |

|

| Business insurance | Protects businesses from financial losses due to accidents, lawsuits, or other unforeseen events. | There are many different types of business insurance policies available, so you can choose one that fits your business’s needs. Some policies cover property damage, while others cover liability if someone is injured on your property. |

|

| Property insurance | Protects your property from damage caused by fire, theft, or other disasters. | Covers the cost to repair or replace your property, as well as liability if someone is injured on your property. |

|

| Liability insurance | Protects you from financial losses if you are sued for causing injury or damage to someone else. | It is important to have liability insurance if you own a car, a home, or a business. Some liability insurance policies cover bodily injury, while others cover property damage. |

|

| Travel insurance | Covers your medical expenses, trip cancellation costs, and other expenses if you travel and something goes wrong. | It is important to have travel insurance if you are traveling to a foreign country or if you are traveling during the winter months. Some travel insurance policies also cover lost luggage and cancellation of your trip due to a covered event. |

|

| Pet insurance | Covers your pet’s medical expenses, such as vet bills, surgery, and prescription drugs. | It is important to have pet insurance if you have a pet that is prone to getting sick or injured. Some pet insurance policies also cover preventive care, such as vaccinations and checkups. |

|

| Long-term care insurance | Provides financial assistance if you need long-term care, such as nursing home care or assisted living. | Long-term care can be very expensive, so it is important to have long-term care insurance if you think you might need it in the future. Some long-term care insurance policies cover a set number of days of care, while others cover a lifetime of care. |

|

| Identity theft insurance | Covers the costs of repairing your identity if it is stolen, such as the cost of replacing your credit cards, driver’s license, and other documents. | Identity theft can be a very costly and time-consuming experience, so it is important to have identity theft insurance if you think you might be a victim. Some identity theft insurance policies also cover the cost of legal fees if you are sued as a result of identity theft. |

|

| Annuities | These are insurance products that provide you with a stream of income in retirement. | Annuities can be a good way to save for retirement and to guarantee a certain income stream in retirement. There are many different types of annuities available, so you can choose one that fits your needs and budget. |

|

| Medigap | This type of insurance helps to pay for the costs of Medicare that are not covered by Original Medicare. | Medigap can be a |

w3techpanel.com insurance

here are some more types of w3techpanel.com insurance:

- Business insurance protects businesses from financial losses due to accidents, lawsuits, or other unforeseen events.w3techpanel.com insurance

- Property insurance protects your property from damage caused by fire, theft, or other disasters.w3techpanel.com insurance

- Liability insurance protects you from financial losses if you are sued for causing injury or damage to someone else.w3techpanel.com insurance

- Travel insurance covers your medical expenses, trip cancellation costs, and other expenses if you travel and something goes wrong.w3techpanel.com insurance

- Pet insurance covers your pet’s medical expenses, such as vet bills, surgery, and prescription drugs.w3techpanel.com insurance

- Long-term care insurance provides financial assistance if you need long-term care, such as nursing home care or assisted living.w3techpanel.com insurance

- Identity theft insurance covers the costs of repairing your identity if it is stolen, such as the cost of replacing your credit cards, driver’s license, and other documents.w3techpanel.com insurance

- Annuities are insurance products that provide you with a stream of income in retirement.w3techpanel.com insurance

- Medigap is a type of health insurance that helps to pay for the costs of Medicare that are not covered by Original Medicare.w3techpanel.com insurance

- Medicaid is a government-funded health insurance program for low-income individuals and families.w3techpanel.com insurance

These are just a few of the many types of insurance that are available. The type of insurance that you need will depend on your individual circumstances and needs. It is important to do your research and compare quotes from different companies before you purchase an insurance policy. w3techpanel.com insurance